how to pay indiana state taxes quarterly

Indiana state filing information for tax-exempt organizations. In addition part-year residents must also pay taxes in Indiana by filling out a different form IT-40PNR.

Public Auction An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties in its possession.

. Learn how to file your state payroll tax forms and pay your state taxes electronically. State Law Requirements for Bylaws. The majority of Indiana employers must pay quarterly SUTA contributions unless the employer is a qualifying not-for-profit or they themselves are the government at such point that employer can elect to reimburse the state at a time where their.

There are two types of vehicle fuel tax accounts. Yearly renewals decals and license cards are required. International Fuel Tax Agreement IFTA for interstate carriers who travel in Indiana plus at least one.

Paying your state payroll taxes and filing the necessary state forms on time throughout the year is an essential task. Skip to main content An official website of the United States Government. The Indiana State Unemployment Tax Act SUTA lays out the guidelines for Indiana businesses state unemployment tax.

Indiana has reciprocal agreements with some states including Wisconsin and Kentucky which allow people living in Indiana and working in these states to pay income tax to. This is the fastest and easiest. A State program offered to senior blind or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria.

Therefore independent contractors are required to file quarterly estimate income tax payments with DOR. If the independent contractor hires employees the independent contractor is an employer and is required to withhold Indiana adjusted gross income tax and local option income taxes from the employees wages and remit them to DOR. State Charities Regulation State Tax Filings State Filing Requirements for Political Organizations.

Quarterly tax returns must also be filed. Exempt organizations must keep books reports and file returns based on an annual accounting period called a tax year. For additional information on what the state may require with respect to bylaws you may want to contact state officials.

In QuickBooks Desktop Payroll Enhanced you can pay taxes and file forms electronically for most states. Reciprocal States Even though Indiana and Illinois are neighbors they are not considered reciprocal states. A tax year is usually 12 consecutive months.

State By State Click Through Nexus Guide

Taxation Of Social Security Benefits Mn House Research

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Reciprocal Agreements By State What Is Tax Reciprocity

Indiana State Tax Updates Withum

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Reciprocal Agreements By State What Is Tax Reciprocity

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

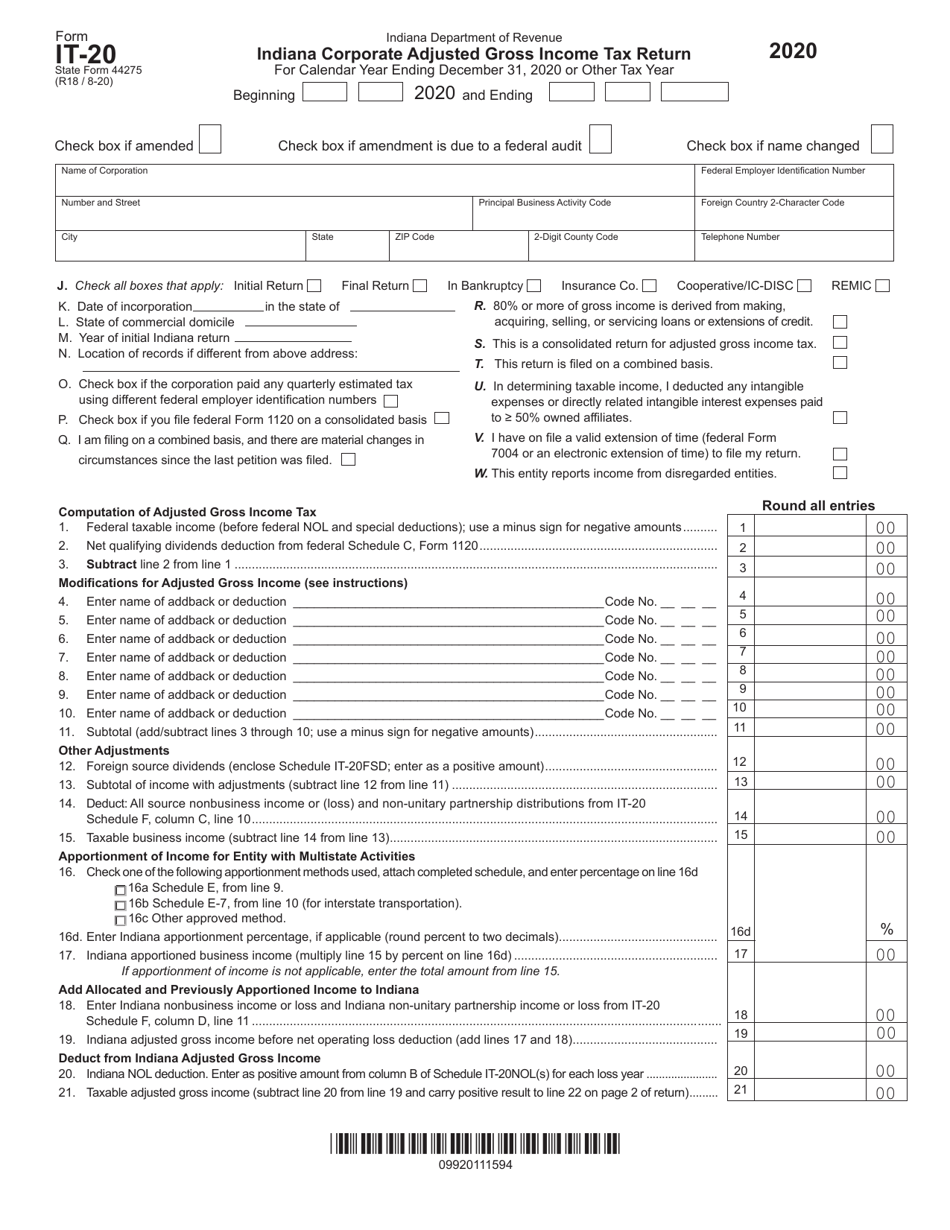

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

Indiana Sales Tax Small Business Guide Truic

Indiana State Tax Information Support

Helpful Sales Tax Steps For Amazon Fba Sellers Sales Tax Amazon Fba Business Tax Return